Posts by James M. Nelson

The Harlan Crow—Clarence Thomas connection no one saw coming—RealPage

Introduction: In October 2022, ProPublica broke a story about a little-known company, RealPage, which was artificially increasing rental rates on apartments. Later that month, lawsuits were filed against RealPage alleging price-fixing and market manipulation. In November 2022, the Department Of Justice opened an investigation into them. This is all based on the research of James M. Nelson,…

Read MoreWhat is Moral Hazard and Why Should You Care?

Why you should be very concerned about the recent bank failures. Since Reagan, financial institutions over $10 billion have mostly been left to self-regulate. Moral hazard ran amuck throughout our financial systems preceding the 1990s and 2008 financial crashes. And the recent bank failure of Silicon Valley Bank is a powerful sign that it’s happening…

Read MoreThe RealPage Common Pricing Platform is Designed to Circumvent the State’s Landlord-Tenant Act —the Question Becomes, What’s Reasonable?

The Problem? Imagine, if you will, a story about someone like you. Meet Jane and John Doe and their two toddlers. They live in Seattle, Washington, where they rent a two-bedroom apartment. It’s a story about one day, just one day in their life, a day that would change everything. However, to them, that day…

Read MoreI took a four-year-long sabbatical to research the rental housing industry, and what I found will shock you

The multifamily rental market in metropolitan areas has experienced skyrocketing rental rates over the past decade. Many casual observers believe the cause of this surge in rental rates is the rapid influx of new residents in urban areas. Just a simple supply and demand logic: demand went up, and supply did not rise with it,…

Read MoreThe CMBS and the Fed…is there a crisis brewing in the Rental Housing Industry? The Good, the Bad, and the Ugly…

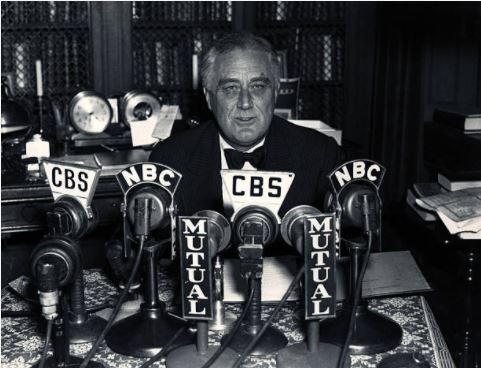

After the financial crashes in 1929, the Roosevelt Administration established the process of financing our homes through the New Deal. Before this, the Federal Government played no role in our housing. During this period (1930 to 1972), homeownership reached an all-time high and was very affordable. However, at inflection point 1, (below) the Nixon administration changed the financing rules and put the responsibility back into private enterprises’ hands. n this blog, we will discuss the housing crashes and their causes. At inflection point 4, we discuss the current impending housing crash and its most likely causes–Risk vs. Moral Hazzard.

Read MoreRenters! What’s in Your Utility Bill? The Devil is in the Details!

Renters, have you ever wondered what you are paying for in your utility bill? Well, perhaps it is time to look. While we weren’t looking, the billion-dollar Utility Billing Industry has been formed assisting the Landlord in creating additional income. This is how they do it. The Utility Billing Industry In my last post, we…

Read MoreA New Deal for the American Renter: Solving the Eviction Crisis

With the Eviction Crisis looming and millions of Americans facing the threat of homelessness, many Americans are left wondering, “will the government bail out the people?” The US Government has spent billions of dollars in the last two decades doing just that for Wall Street. Banks and investment firms that defrauded the public and blew…

Read MoreThe Elephant in the Economic Recovery Room: The High Price of Real Estate

In early April, Congress approved a small business relief fund of $376 billion. When that amount proved inadequate, they offered an additional $310 billion. Today, the Biden Administration is again seeking additional funding to keep small businesses afloat. While this was a powerful gesture on Congress’s part to support the many small businesses across the…

Read MoreThe Value of a Dollar and Political Chaos

I will never forget my first economics class at the university. My professor, a member of Ford’s board of directors and an economic advisor, asked a student for a dollar bill. The professor then held up the bill and requested a straightforward question, “What is this one-dollar bill worth?” A discussion ensued between class members.…

Read MorePandemics and Financial Crisis: How Our Ancestors Survived the Great Depression and left us a Better World

When we travel back to the Great Depression to determine what caused such an epic economic meltdown, history provides an excellent lesson for us today. History has given us this unique opportunity to pull back the curtains, to look and see what our ancestors said and did. Such was the magnitude of their challenges; some…

Read More