Renters, have you ever wondered what you are paying for in your utility bill? Well, perhaps it is time to look. While we weren’t looking, the billion-dollar Utility Billing Industry has been formed assisting the Landlord in creating additional income. This is how they do it.

The Utility Billing Industry

In my last post, we discussed the New Landlord [not mom n’ pop operators] but those associated with the shared operating platform. For the new Landlord, it’s more important than ever to work with a utility advisor who understands how to navigate the complex utility world. For example, Amye Baker, VP of RealPage Utility Management, states that for Property Managers, saving money on utilities can be done simply by understanding legal compliance. A comprehensive utility management program opens opportunities to reduce expenses and recover more money from their tenants.

Companies like UB West and American Utility Management offer unconventional methods of utility billing options.

Let’s begin with a couple of definitions:

What are Common Area Maintenance (CAM) costs?

Common Areas of an apartment community include areas available to all community members including drive-ways, walk ways, parking spaces, club-house accommodations, the office, and facilities and these areas incur operating costs. Historically, these costs were the responsibility of the property owners.

What is Ratio Utility Billing System (RUBS)?

RUBS is the process landlords use to calculate a tenant’s utility consumption based on factors such as square footage, number of bedrooms, and /or occupants’ number.

Today, landlords are using alternative methods to calculate those utility assessments for their tenants. New Property Managers like Apartment Management Consultants (AMC), promise the property owners that they will pass up to 98% of all common area expenses to their tenants.

So, how are the managers capturing those charges from their tenants? Per Figure 3, for the most part, they are utilizing the utility systems as the means of capture. We will turn our attention to a study from Ohio and California to better understand this program and how it works.

The Ohio Study

Here’s how it typically works

Per Figure 1, The Property Manager sells the utility meters and distribution system within an apartment complex to a holding company typically made up of the same property owners or the hired management company. It then buys electricity or water, or both, from utilities and re-sells them to tenants, at those inflated prices, and with fees.

Figure 1, Utilities are Purchased by Middlemen and resold to their tenants

Dan Gearino reported in the Columbus Dispatch that their Ohio study found residents pay mark-ups of 5 percent to 40 percent when their landlords enter into contracts with submeter companies. And that doesn’t include a host of submeter fees, which can easily exceed $30 a month, according to sources.

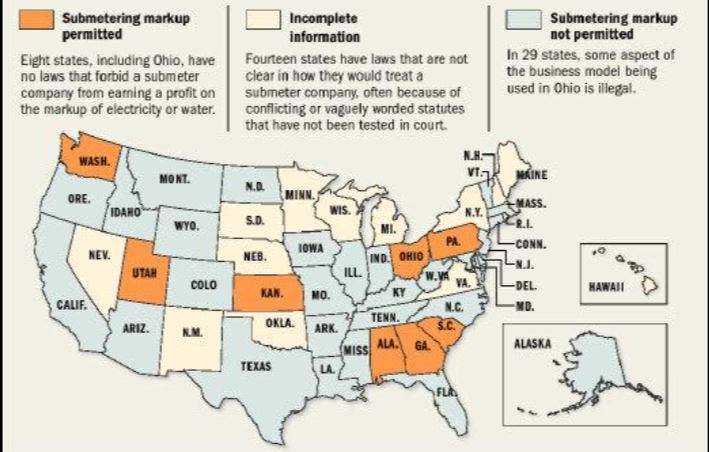

Figure 2. US Map of Utility Regulations by type

They can operate this program because most apartments receive one bill for the services. The property managers are the only party involved in the distribution methodologies. In many states, this type of utility resale is banned by law or rule. That leaves, per Figure 2, just a few other states where it is allowed: Alabama, Georgia, Kansas, Ohio, Pennsylvania, South Carolina, Utah, and Washington.

How they Disclose their Utility Billing Programs

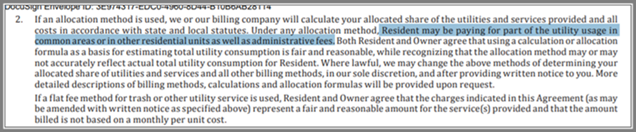

Buried in the lease addendums, per Figure 3, the landlords admit they are charging the RUBS directly to the tenants via the utility billing statements.

Figure 3. Notice to Tenant of right to Charge CAM—hidden deep in the contract

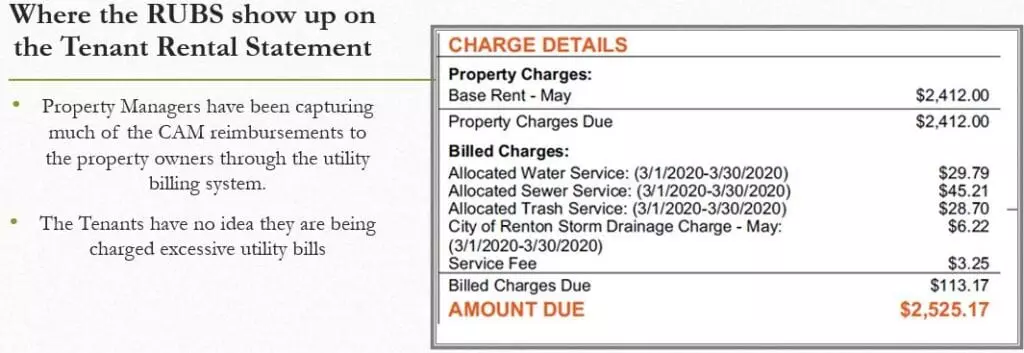

Figure 4 provides a copy of a real billing statement which details how the CAM is captured. In short, the tenants are entirely unaware that they are paying excessive utility billings.

Figure 4.Where the RUBS show up on the Tenant Rental Statement

“We’re being victimized,” said Dustin Flowers; his most recent bill was 23 percent more than it would have been at the regulated price. “I’ve lost sleep over this.”

“they pretty much told me that I don’t have a choice, and this is how it is,” said Rachelle Sexton. Her August bill was $176.24, which was 30 percent more than she would have paid for the same usage at regulated prices.

see Bibliography

How do they accomplish this? Legions of Lawyers and a Massive Database

RealPage’s in-house legal team is the largest, most experienced in the industry. Furthermore, they maintain a national database of every state, county, municipal laws, ordinances, and regulations, including those covering submetering, billing, and energy management.

“With RealPage in your corner, you don’t have to worry about keeping up with changing regulations either—that’s our job.”

Rest assured, they are monitoring and responding to legislative activity to represent their interests.

RealPage

The AI technology is driven by massive amounts of data that have been trained to maximize profits for the property owner. A case in point is Minnesota, like many states, where the laws are unclear regarding what landlords can charge in fees when compiling utility statements. A recent court case rendered the following verdict:

Now, what about regulated markets like Minnesota and California?

Minnesota Statutes section 504B.215 (2014) does not prohibit a landlord from billing tenants for fees charged in connection with tenants’ utility bills and does not require that those fees be equitable compared to the costs of the utility services apportioned among tenants.

Judge HUDSON,

Meaning that they can charge all the excessive fees they desire to maximize profits.

The California Study:

The Financial Benefits to the Property Owners

So how does this program benefit the property owners? It increases income and property values and to understand how they accomplish this we will turn our attention to a real-life scenario. The information in this study originates from the appraisal. The property uses a RUBS program, whereby the utility expenses are paid by Landlord and reimbursed by the tenants. The residents are sub-metered for gas, electricity, and water service; the balance is flat-rate, trash, and such.

RUBS Income and Expense

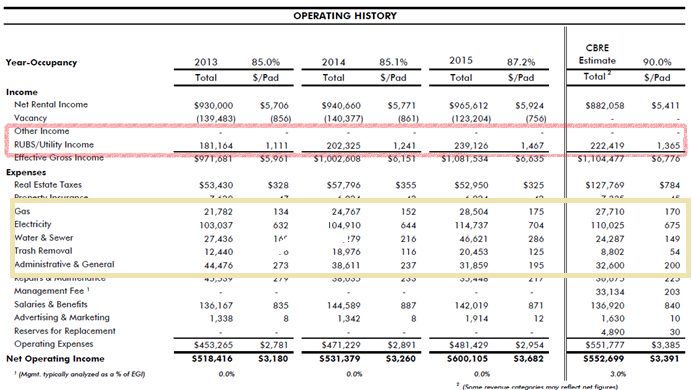

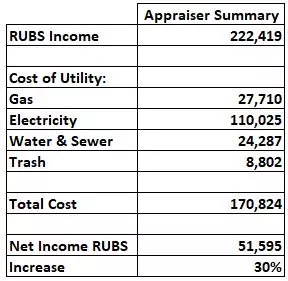

In Figure 5, the section outlined in red details the Rubs/ Utility amounts paid by the tenants to the Landlord who records the funds as income. The area outlined in yellow details the various utility expenses and the amounts the Landlord pays for those utilities.

Figure 5, Income History from Appraisal Reflecting Rubs Income & Expenses

In Figure 6, we break out the actual utility income and offsetting costs per Figure 5 (far right) CBRE Estimate, providing the landlords’ net income. These are the numbers the appraiser uses in their calculation of NOI and the value of the property

Figure 6, Income Reflecting Rubs Income & Expenses (focus section from Figure 5)

The example allows us to examine how the utility billing program yields massive profits to property owners. According to the Ohio Study, our example is considered the average markup rate. The owners [middlemen] charged a price increase of 30.2% on the utilities, which increased the owner’s (Net Operating Income) NOI by an average of $51,595 per year and the increase in NOI yields an increase in property value of $938,091—proving that the Utility Billing Program works for the property owners.

What Does This Mean for You?

For example, in the state of Washington, below is all the disclosure required to meet the legal requirements. And we are none the wiser until we begin looking into the details.

Per Figure 3, Resident may be paying for part of the utility usage in common areas or in other residential units and administrative fees [some leases included taxes].

(from the lease contract)

That’s it, in a stack of 40 to 90 pages of lease documents and buried in the Addendums.

It’s all perfectly legal. Or is it?

What’s 30 percent of your utility bill? What would you have spent that money on if you had it back in your pocket?

My economic Study on housing concluded that this is just the tip of the proverbial iceberg. There are many, many programs such as this one. Our findings concluded that the new landlord’s leasing program, using options like the utility program, gain additional income of between 20 and 43 percent over what the tenant ever understood their housing would cost, and that’s all by design.

So, What do we Do?

Unfortunately, this problem isn’t going to fix itself; the property owners are making too much money. It will take work to fix this. We as community citizens must push our legislators to fix this problem; this is a legislative issue.

We need to contact our local, state, and national congressional representatives and let them know that these types of deceptive programs need to be regulated and fixed. As the saying goes, the squeaky wheel gets the grease.

Find Your Elected Officials Here: https://www.usa.gov/elected-officials

So, Start Squeaking!!!!

Please, like, and share my blog. Visit my website at www.jamesmartinnelson.com

This Blog is a summary from the Economic Study, The New Landlord, a Study on the Three-Part Leasing Strategy, Powered by Big Data, and Artificial Intelligence©

Bibliography:

- We Are Apartment Management Consultants,” Apartment Management Consultants, LLC, accessed September 2019, https://www.amcllc.net/amcrfp.pdf

- Website of American Utility Management, “How can your properties reduce costs and become more energy efficient?,” aum-inc.com, accessed December, 2020,https://www.aum-inc.com/solutions/energy-management

- The website for AUM, “Energy Benchmarking Requirements for Multifamily Properties,” aum-inc.com, February, 2016, https://www.aum-inc.com/news-article/2016/02/10/energy-benchmarking-requirements; and, https://www.aum-inc.com/docs/default-source/default-document-library/epa-benchmarking-doc-for-website.pdf?sfvrsn=4

- The Website of RealPage, Inc., “Finding Yield through Multifamily Utility Management,” marketscreener.com, December, 2020, https://www.marketscreener.com/quote/stock/REALPAGE-INC-6486081/news/RealPage-Finding-Yield-through-Multifamily-Utility-Management-32002796/

- Website of Utility Billing West, “5 Benefits To A RUBS Utility Billing System,”https://www.ubwest.com/multifamily-utility-billing/5-benefits-to-a-rubs-utility-billing-system/

- The Website of American Utility Management, “The AUM Advantage,” accessed September, 2020, https://www.aum-inc.com/home

- Dan Gearino. “Shocking cost investigation: Utility middle men charge renters inflated prices,” The Columbus Dispatch, October, 2013, accessed September, 2020, https://www.dispatch.com/article/20131020/NEWS/310209773

- Office of the Ohio Consumers’ Counsel, “Testimony on House Bill 483 (Omnibus Amendment)

(Consumer Protections on Master-Metering, Submetering and Reselling of Public Utility Services)

By Bruce Weston Ohio Consumers’ Counsel Office of the Ohio Consumers’ Counsel,” occ.ohio.gov, April, 2014, http://www.occ.ohio.gov/sites/default/files/lservices/testimony/2014-04-08.pdf. - Better Business Bureau Complaints Department, September 2020, https://www.bbb.org/us/ut/sandy/profile/billing-services/utility-billing-west-llc-1166-22173165

- The Website of RealPage, Inc., “Utility Cost Benchmarking for Property Owners,” accessed September, 2020, https://www.realpage.com/utility-benchmark/

- The Website of RealPage, “Resident Utility Billing Services,” accessed September, 2020,https://www.realpage.com/utility-management/billing/