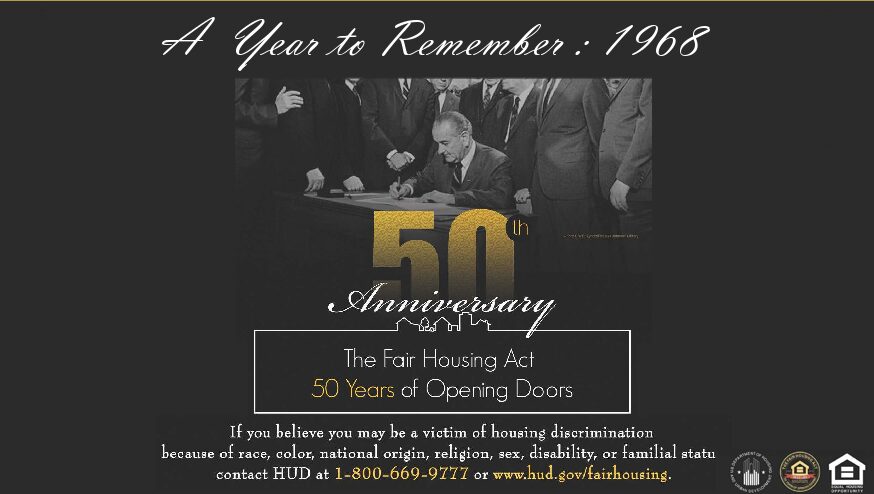

Title VIII of the Civil Rights Act of 1968 prohibits discrimination in the sale, rental, or financing of dwellings and in other housing-related activities based on race, color, religion, sex, disability, familial status, or national origin.

Congress gave the authority and responsibility for administering the Fair Housing Act and the power to make rules to carry out the act to HUD.

In 2015, in the case of Texas Department of Housing and Community Affairs v. Inclusive Communities Project, Inc., the Texas Supreme Court undertook its own analysis of the Fair Housing Act and discussed the standards for constitutional questions and necessary limitations regarding disparate impact claims. Later, HUD secretary Ben Carson decided to use these amendments to bring HUD’s disparate impact rule into closer alignment with the analysis and guidance provided in Texas v. Inclusive Communities as understood by HUD, to codify HUD’s position that its rule is not intended to infringe upon any state law.

In discussing disparate impact liability, the court had noted that “disparate-impact liability must be limited, so employers and other regulated entities can make the practical business choices and profit-related decisions that sustain a vibrant and dynamic free-enterprise system.” The Court also prohibited disparate impact suits that would displace “valid governmental and private priorities.”

The HUD rule goes on to establish unprecedented guidance for Artificial Intelligence-driven technology that powers the housing market by delivering reports on credit risk, home insurance, mortgage interest rates, and much more. Under the new rules, lenders would not be responsible for the effects of an algorithm provided by a third party—a policy that would create an industry back door to discrimination.

“This is a proposal to very dramatically revise and effectively destroy an existing 2013 civil rights regulation,” says Megan Haberle, deputy director for the Poverty & Race Research Action Council. “This is a core part of the Fair Housing Act, and very early fair housing cases across the country have recognized the discriminatory effects standard.”

Kriston Capps, a staff writer for CityLab, said that “in addition, the new HUD rule would establish three new defenses for landlords, lenders, and others accused of discrimination based on models and algorithms. The first defense would enable defendants to indicate that an algorithm model isn’t the cause of the harm. The second would allow the defendant to show that a model or algorithm is being used as intended and is the responsibility of a third party. Finally, the new rule would allow the defendant to call on a qualified expert to show that the alleged harm isn’t an algorithm model’s fault.”

Natalie Moore reported through NPR that “the Fair Housing Act recognizes disparate impact. The US Supreme Court upheld it. Now the US Department of Housing and Urban Development (HUD) wants to replace an Obama-era rule that codified disparate impact when dealing with housing discrimination cases.”

HUD argues that disparate impact is vague, and the proposed rule puts in a five-step process raising the burden of proof on the complaining party. “I would argue it’s impossible to prove discrimination,” said John Petruszak of the South Suburban Housing Center.

HUD proposed the rule in August 2019.

The Consequences of Discrimination in the Housing Markets

On February 2, 2016, David Grusky and Clifton B. Parker published a study in the Stanford News that concludes we live in a racially and economically divided society. “In fact, the US ranks at the bottom when it comes to comparative data on poverty, employment, income and wealth inequality, education, health inequality, and residential segregation. Current policies and practices reinforce and perpetuate segregation and inequality. We simply cannot prosper as a nation with this level of inequality and division. Housing lies at the very center of this phenomenon. What we do about access to housing opportunity and the dismantling of segregation affects the entire fabric of our nation.”

In America today, just about half of all black Americans and 40 percent of all Latinos live in neighborhoods without a white presence. The average white person resides in a community that is nearly 80 percent white. To exacerbate the problems, there were 28,181 registered housing discrimination complaints in 2016; all left unanswered by the now-defunct CFPB. Also, some 91.5 percent of all acts of housing discrimination reported in 2016 occurred during the rental prescreening process.

In the case of the disparate impact rule, the AI-technology networks would profoundly influence or manipulate the learning insights and assumptions within the algorithms, causing grave concern for how data is used in cases in which transparency may be essential for regulatory purposes. At the end of the day, should HUD implement AI-driven technology into its mainframe, this governance system without the proper oversight would allow discrimination to destroy the housing markets for the next generation of homeowners.

The time has come for Americans to take a stand; we must acknowledge our sullied past and our hand in discrimination and must make things right. Sometimes as a society, to move forward, we must first clean up our past.