The relations between the primary and secondary mortgage markets are the basis of the mortgage lending process and are an essential part of our housing industry. Our mortgage markets’ structure and framework have enabled the real estate lending industry to expand to over $7 trillion in outstanding loan balances.

The Primary Mortgage Market

The primary mortgage market is the market where lenders issue mortgage loans by lending directly to borrowers/customers.

Secondary Mortgage Market Explained

The secondary mortgage market refers to the market that comprises the buying and selling of mortgage loans from the primary mortgage market or from each other. The secondary mortgage market serves as a source of funds for the loan originators to continue making loans and generating income.

Before the secondary market was established, only larger banks had the extensive funds necessary to provide the funds for the life of the loan, usually for 15 to 30 years. Because of this, potential homebuyers had a more difficult time finding mortgage lenders. Because there was less competition between mortgage lenders, they were able to charge higher interest rates. The 1968 Charter Act solved this problem by creating Fannie Mae and Freddie Mac two years later. These government-sponsored businesses were able to buy bank mortgages and resell them to other investors. Instead of reselling the loans individually, they were bundled into mortgage-backed securities, which means their value is secured or backed by the value of the bundle of mortgages.

The Federal Home Loan Banks

Congress passed the Federal Home Loan Bank Act in 1932 to establish the Federal Home Loan Bank System and reinvigorate a housing market devastated by the Great Depression.

The Federal Home Administration (FHA)- Insures Mortgage against Default

Congress created the Federal Housing Administration (FHA) in 1934. The FHA became a part of the HUD in 1965. FHA provides mortgage insurance and provides lenders with protection against losses if a property owner defaults on their mortgage.

Today, FHA has active insurance on over 8 million single-family mortgages, almost 12,000 mortgages for multifamily properties, over 3,700 residential care facilities mortgages, and nearly 100 mortgages for hospital facilities. The combined unpaid principal balance in FHA’s insurance portfolio is over $1.3 trillion.

Federal National Mortgage Association (Fannie Mae)

The Federal National Mortgage Association (Fannie Mae) was created by Congress in 1938 but was not privatized until 1968 to stabilize the housing markets in the aftershock of the Great Depression. Initially, FNMY was established to buy and sell FHA-insured loans from banks, and VA-guaranteed loans were added in 1944 as part of the benefits for soldiers. Its role was expanded in 1972 (as part of the Nixon Policy Changes) when Fannie Mae was permitted to buy and sell conventional mortgages. This made Fannie Mae the largest investor in the secondary mortgage market.

Starting in 1970, the charter of Freddie Mac set things in motion. Fannie Mae and Freddie Mac created a secondary market for mortgages, which would increase liquidity on the bank’s balance sheets, meaning that lenders no longer had to hold those mortgages but could sell them into the secondary market once they originated. This, in turn, freed up their capital such that they could then make new mortgages.

Ginnie Mae- guaranty of timely principal and interest payments to Bond Holders

For over 50 years, Ginnie Mae has provided market stability and liquidity to America’s housing finance system. It is a significant outlet for providing global capital to the housing market, ensuring a steady funding source for the vast majority of the government-insured or guaranteed loans offered.

Unlike Fannie Mae or Freddie Mac, the underlying mortgages are not Ginnie Mae’s assets. Instead, issuers securitize these mortgages and sell them to investors (Securitized Bonds) with Ginnie Mae’s guaranty of timely principal and interest payments. This guaranty is backed by the full faith and credit of the U.S. government.

Part 1. The Primary and Secondary Mortgage Markets—How they Work

When you take out a home loan, the loan is underwritten, funded, and serviced by a lender. We will use the following example of a person acquiring the home of their dreams through a typical FHA 3% down payment, home mortgage process. You have selected a lender such as Quicken Loans, the largest fintech lender in the country. The purchase price is $200,000, and you will be using PMI due to the minimum down payment.

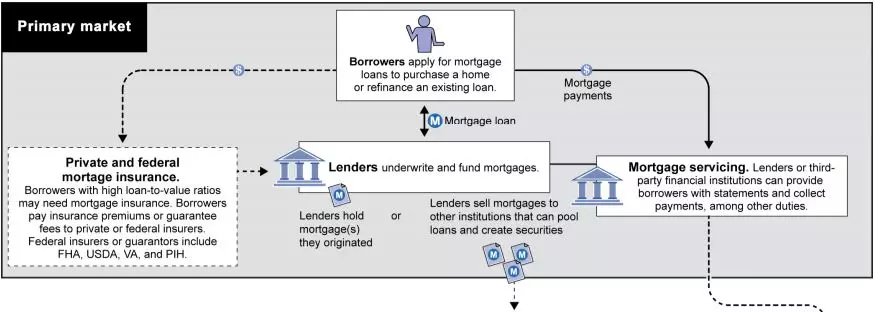

Figure 1. The Primary Market

In this example, the reader can track both the borrower’s mortgage note and their future payments and servicing by the color-coded details.

Step 1. Lender funds Loan and owner take possession of the home. The borrower utilizes the PMI insurance program.

Step 2. Lender funds the Loan from their Warehouse Line of Credit, and they will retain the loan in their portfolio; however, they will sell the servicing rights to a third party servicer (nonbank).

They pay-down their credit lines by selling a tranche of $250Million worth of loans into the secondary markets; this loan is included. The loans are often sold to large securitizers, such as Fannie Mae.

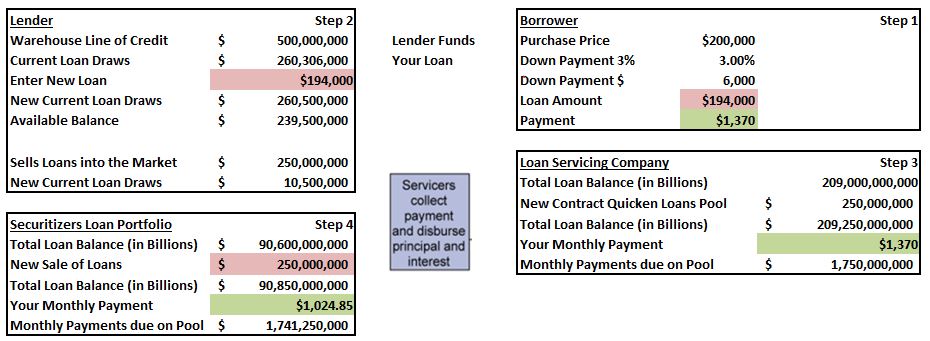

Figure 2. Example of the Life Cycle of the Home Mortgage Loan

Step 3. After the lender issues the borrower a loan, all their future dealings are handled by a commercial mortgage servicer, called a master servicer. The master servicer collects all future MBS loan payments.

The Servicer collects loan payments, and the reader will notice that the mortgage payment of $1,370 is made to the Loan Servicer; however, the servicer retains the escrow accounts and forwards just the Principal and Interest to the Note Holder.

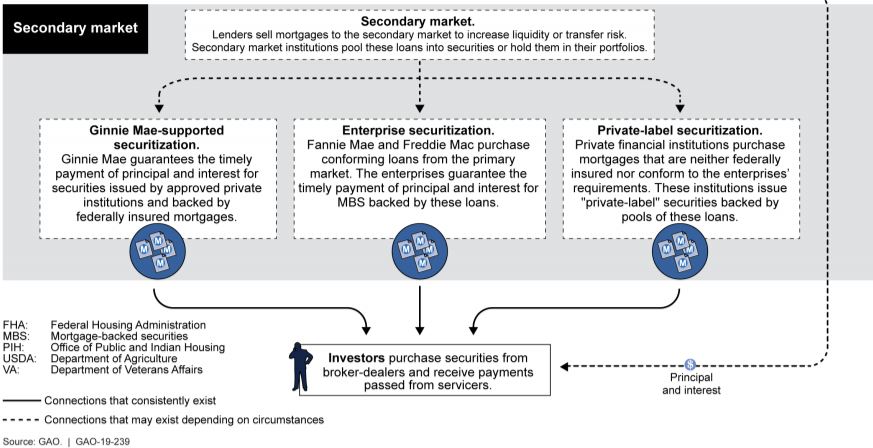

Secondary Mortgage Market Explained

The secondary mortgage market is where mortgages and various servicing rights are bought and sold between lenders, servicers, and investors. Multiple types of Mortgages are sold into the secondary market and pooled into mortgage-backed securities and then sold to investors—including insurance companies and hedge funds.

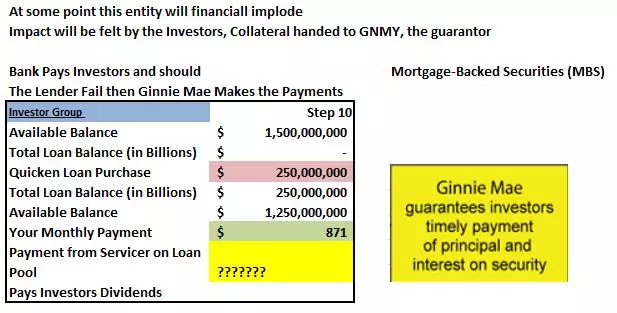

Ginnie Mae’s guarantee provides investors with fixed-income security that has the same credit quality as a U.S. Treasury bond. Therefore, investors do not face credit risk—the possibility of loss from unpaid mortgages—because Ginnie Mae guarantees timely payment of principal and interest.

Step 4. The securitizers purchase the $250Million tranche; including this loan, and once funded, the loans are combined into pools, made up of a diverse selection of mortgage type loans, the conduit loans are placed into a Real Estate Mortgage Investment Conduit (REMIC) Trust and then sold to investors.

Figure 3. The Secondary Market

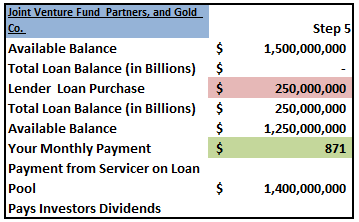

Step 5. The company Joint Venture Fund purchases the $250Million tranche, including this loan, and once funded, the loans are combined into their investment pools. They receive payments from the securitizer.

Figure 4. Investor Bond Portfolio

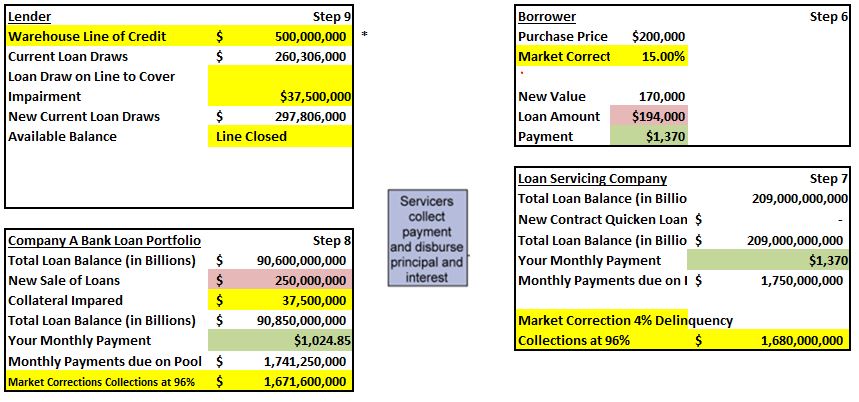

Part 2 The Example Market Correction

To continue our example, in this scenario, the economy has entered into a market correction similar to 2008, and therefore, the 4% delinquency rate is utilized.

Step 6. Our borrower has fallen onto hard times, just $400 away from the streets. The home’s value has fallen 15%, and now the home is worth less than the loan amount.

Step 7. The loan servicer cannot make the mortgage payments and begins to default on their financial responsibility.

Ginnie Mae’s primary risk is their third-party connections. This is the risk that an issuer or servicer fails to maintain the financial strength and liquidity necessary to advance principal and interest and absorb un-reimbursed losses on mortgage loans underlying their MBS issuances.

Step 8. The Securitizer holding the mortgages is taking heavy losses from the loan portfolio in the amount of 15% or $37,500,000. The loss-share agreements with the original lender allow them to seek restitution on the percentage of the holdback.

At some point, the losses will eventually hit the securitizer, which in this instance, is a non-banking entity.

Figure 5. Example of the Life Cycle of the Home Mortgage Loan- Market Distress

Step 9. The Lender draws the $37,500,000 from the Warehouse line to pay the securitizers on the loss-share arrangement. The Warehouse Lender then realizes that the nonbank lender is in financial trouble and, as a result, restricts their lines; then eventually closes them. Financial Default follows.

Figure 6. Warehouse Line of Credit in Practice

Part 3- The Fees

Closing costs are typically 1-5% of the mortgage balance and cover costs associated with closing the transaction, such as legal and processing fees paid to the originator.

Shadow Banking fees appear on the high end of the typical range. For example, on consumer review sites, a common complaint regarding Quicken Loans, the largest fintech lender in our data, is its high origination fees relative to other lenders. Several lenders, including Quicken Loans, provide closing cost estimators for purchases and refinances. For the purchase of a $200,000 home with a 20% down payment in Illinois, the calculator estimates an origination fee of $8,648, which is 5.4% of the principal balance at origination.3

What is Loan Syndication

Loan syndication is the process of involving a group of lenders in funding various portions of a loan for a single borrower. Loan syndication most often occurs when a borrower requires an amount too large for a single lender to provide or when the loan is outside the scope of a lender’s risk exposure levels. Thus, multiple lenders form a syndicate to provide the borrower with the requested capital.

What are Nonbank Lenders?

Nonbank Lenders are financial institutions that are not considered full-scale banks because they do not offer both lending and depositing services. Banks typically have deposit insurance; people don’t worry in times of trouble; in contrast, Shadow banks don’t have that safeguard.

Not only do NBFCs provide alternate sources, proponents say, they also offer more efficient ones. NBFCs cut out the middleman—as banks often are—to let clients deal with them directly, lowering costs, fees, and rates, in a process called disintermediation. Providing financing and credit is essential to keep the money supply liquid and the economy humming.

NBFCs are officially classified under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. The Act describes them as companies “predominantly engaged in a financial activity” when more than 85% of their consolidated annual gross revenues or consolidated assets are financial in nature.

End Notes:

- Andreas Fuster, Laurie Goodman, David Lucca, Laurel Madar, Linsey Molloy, and Paul Willen, “The Rising Gap between Primary and Secondary Mortgage Rates,” FRBNY Economic Policy Review, December 2013, https://www.newyorkfed.org/medialibrary/media/research/epr/2013/1113fust.pdf.

- “The Federal Housing Administration (FHA),” HUD.gov, accessed January 2020, https://www.hud.gov/program_offices/housing/fhahistory.

- Greg Buchak, Gregor Matvos, Tomasz Piskorski and Amit Seru, “Fintech, Regulatory Arbitrage and the Rise of Shadow Banks,” May, 2017, https://www.fdic.gov/bank/analytical/cfr/bank-research-conference/annual-17th/papers/15-piskorski.pdf.